Maziar Noorbakhsh, the Head of the Transformation, Innovation, and Productivity Commission at the Tehran Chamber of Commerce, has emphasized the potential for financial incentives to encourage real businesses, both individual and corporate, active in domestic digital platforms. These incentives can facilitate their growth and increased activity while concurrently ensuring transparency in their operations.

Financial Incentives and Transparency Key to Nurturing Digital Economy Growth

According to IDEA, Support for businesses in the private sector, particularly those involved in the digital economy, is fundamentally essential for their success and expansion. However, this alone is not sufficient; it is imperative to consistently consider the interests of these businesses’ customers. Hence, a clear roadmap for such support measures, along with defined timelines and key performance indicators, should be established. This approach ensures that the benefits for businesses are evident and that customers’ interests are safeguarded.

Furthermore, the successful execution of these measures must be guaranteed by the Tax Affairs Organization. This organization should have a defined roadmap and be committed to its implementation. One of the primary challenges faced by businesses is abrupt and overnight changes in laws and regulations, leading to losses, closures, or even bankruptcy.

Therefore, it is crucial for the actions and their schedules to be well-defined so that businesses can engage in long-term planning and strategic thinking, ultimately preventing them from facing heavy and sudden tax burdens and setbacks.

Balancing Incentives, Competition, and Regulation for Economic Prosperity

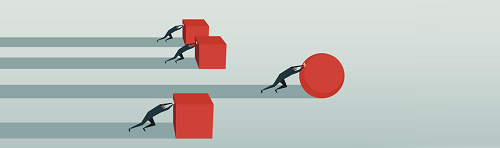

It is evident that, in theory and on paper, the creation of incentives, especially tax incentives, can lead to the growth of businesses, ultimately fostering economic expansion and employment opportunities. Additionally, this action can promote increased competition among platforms, which, in turn, can enhance the quality and pricing of services and products for customers. Consequently, the surge in the number of active businesses on domestic platforms will lead to future increases in tax revenue for the government. However, as mentioned, a clear roadmap and schedule must be established. Sufficient oversight of business operations is crucial to prevent fraud and misuse. Simultaneously, competitiveness among businesses should be strengthened to ensure their survival and growth when incentives and support are eventually phased out, and the government should provide the necessary infrastructure and expansion opportunities.

Ultimately, the most effective solution for addressing private sector challenges lies in removing barriers and facilitating their organic growth. Whenever the government intervenes under the pretext of regulating and organizing the private sector, the results often run counter to the intended objectives. Increased government interference in pricing and the issuance of various licenses has frequently harmed the private sector. In a free-market economy, market forces naturally reach a balance that ensures both consumer interests and those of service and product providers. However, in a command economy with extensive government intervention, intricate layers of problems are created for which there may be no simple solutions. Therefore, the genuine demand of the country’s private sector for growth and progress calls for reduced government interference, deregulation, and the creation of a truly competitive environment for businesses.

[postx_template id=”4061″]

No Comment! Be the first one.